Within today's rapidly changing financial landscape, making well-informed investment choices is increasingly important than ever. Given equity research report of information available, traversing the complexities of the stock market can be challenging for especially the most seasoned traders. Here is where equity analysis specialists enter the picture, providing their expertise to assist individuals and businesses to make sound investment choices. Through leveraging their expertise in data analysis and trend analysis, these experts can provide valuable perspectives that drive improved investment results.

Collaborating with equity analysts enables traders to stay ahead of the curve. These experts utilize a combination of quantifiable analysis and qualitative research, analyzing a range of factors from financial records to market sentiment. Their holistic approach aids to identify potential investment opportunities, assess risks, and develop strategies tailored to specific objectives. In a world in which financial missteps can lead to major setbacks, working with equity analysts is more than a smart choice; it's a tactical approach that can improve your investment journey.

Comprehending Equity Analysis

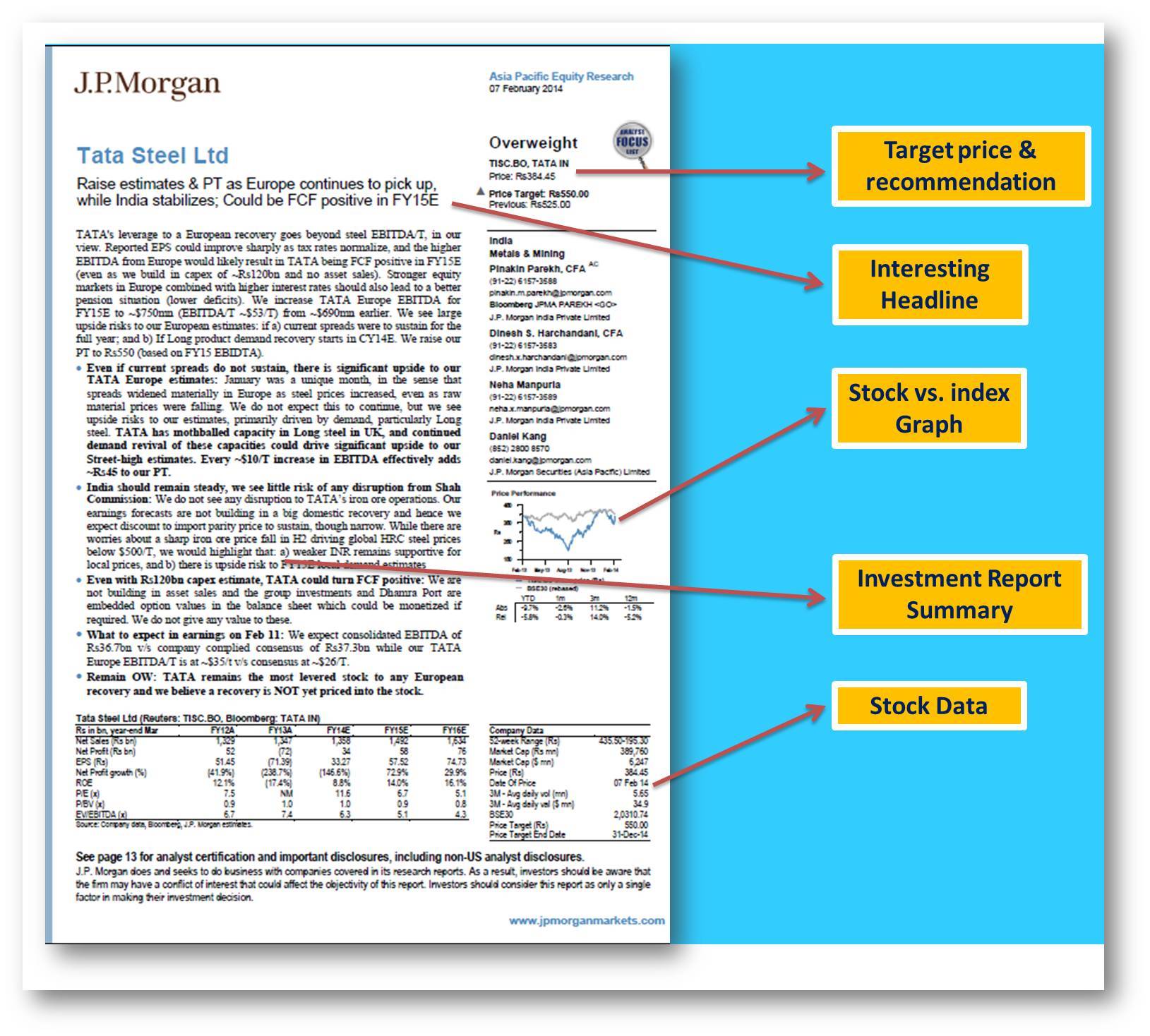

Stock analysis is a thorough examination method that shareholders use to determine the price of a company's shares. This analysis involves examining multiple financial indicators, market conditions, and industry trends to decide whether a stock is inflated or underpriced. The insights derived from this evaluation help traders make informed choices about buying, retaining, or divesting stocks, ultimately impacting their investment strategies and portfolio performance.

At the core of this evaluation are core and technical evaluations. Fundamental analysis focuses on a company's financial health, including its earnings, revenue growth, and overall status. Experts review financial statements, ratio measurements, and economic indicators to measure a company’s potential for future growth. On the other hand, technical analysis analyzes historical price trends and trading levels to forecast future price patterns, using charts and various indicators. Together, these methods provide a solid structure for evaluating stocks.

Engaging with equity analysis specialists can boost this process significantly. These specialists possess the expertise to decipher complex financial figures and recognize broader market indicators that may not be immediately apparent to retail investors. By working with these experts, traders can access detailed analyses and strategic guidance, resulting in more fact-based decisions and possibly higher gains on capital.

Advantages of Employing Experts

One of the primary advantages of hiring equity analysis specialists is their knowledge in the field. These professionals have extensive knowledge of the financial markets, investment approaches, and industry trends. Their analytical skills allow them to analyze complex data and identify investment opportunities that may not be apparent to the average investor. By leveraging their experience, clients can make informed decisions, greatly increasing their chances of achieving positive returns.

Additionally, is the ability to conserve time and resources. Conducting comprehensive equity analysis requires extensive research and continuous monitoring of market conditions. Through outsourcing this task to specialists, clients can focus on their main responsibilities and operations without the distraction of analyzing financial data. This not only enhances productivity but also allows for better strategic planning, as specialists can provide timely insights that assist in aligning investment choices with overall business goals.

Ultimately, equity analysis specialists commonly use sophisticated tools and methodologies that may not be accessible to all. These specialists' familiarity with sophisticated software and analytical techniques enables them to develop comprehensive reports and forecasts. Such insights can provide a competitive edge in the investment landscape, which helps clients to stay ahead of market trends and adjust their strategies accordingly. Ultimately, hiring these specialists can lead to more strategic decision-making and improved financial outcomes.

How to Choose the Right Specialist

Selecting the appropriate equity analysis specialist involves reviewing their qualifications and experience. Look for professionals with a solid educational background in finance, economics, or related fields. Credentials such as Chartered Financial Analyst or Certified Public Accountant can indicate a solid understanding of equity analysis principles. Additionally, take into account their years of experience in the industry and whether they have a proven track record of successful analysis and recommendations.

Another important factor to evaluate is their area of expertise. Different specialists may focus on distinct sectors or types of equities, so it’s essential to align their strengths with your particular investment goals. Research their past performance in the markets you are interested in and seek specialists who have a strong understanding of the particular industries that matter to your portfolio. This alignment can enhance the likelihood of knowledgeable and fruitful investment decisions.

In conclusion, a personal connection and communication style can greatly impact your working relationship. Look for specialists who are not only proficient but also able to communicate their findings clearly. Open lines of communication and a willingness to answer questions will foster a supportive environment. Arrange initial consultations to gauge how well they understand your needs and how effectively they can convey complex information in an clear manner.